May TikTok Shop Beauty & Personal Care Report: Growth Is Back—But Only for Sellers Who Get This Right

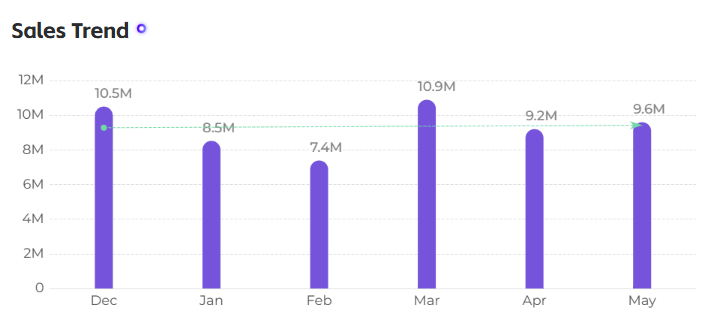

May was a strong month for TikTok Beauty & Personal Care sellers.

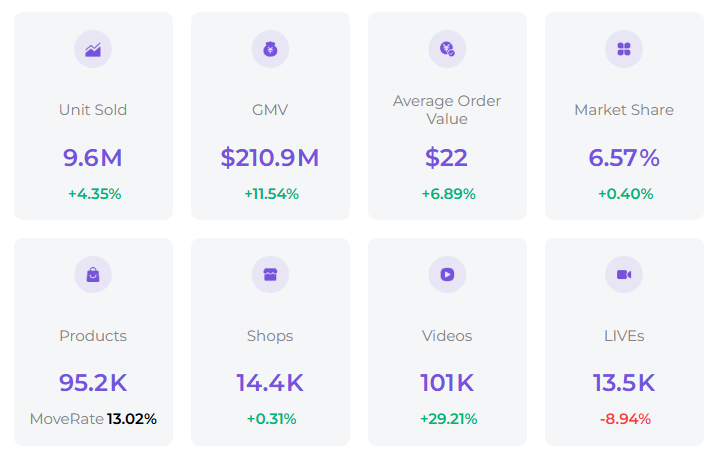

✅ GMV up 11.54%

✅ AOV up 6.89%

✅ Unit sales back to 9.6M

But here's what most people won't tell you:

TikTok isn't rewarding low prices anymore.

It's rewarding the right prices, the right formats, and the right timing.

Insight 1: Buyers aren't buying more—they're buying better

The data is clear:

Units Sold: +4.35%

GMV: +11.54%

Avg Order Value:$22 → Up 6.89%

That means one thing:

TikTok Beauty & Personal Care shoppers are getting picky.

They'll spend—but only if they trust.

Forget racing to the bottom.

What works now is:

● Clear skin benefits

● Creator proof

● Premium packaging

● A TikTok-native story (not repurposed ads)

Insight 2: The$10–$50 price range isn't a sweet spot. It's the whole damn pie.

70%+ of GMV came from mid-range products

$20–$50 alone brought in$99.3M

These price tiers saw over 1.2M creators involved

Why?

Because this range is perfect for:

● Consumer impulse

● Creator commissions

● Sustainable margins

If you're selling <$10, you're invisible.

If you're selling >$50, you're friction-heavy.

But at$20–$40?

That's where conversions fly.

Insight 3: TikTok's algorithm cares about conversion, not catalog size

14.4K active shops

But only 22.21% sell-through rate

More shops, more noise.

But TikTok is evolving.

It doesn't just promote "content"—it promotes results.

Translation?

If your listing:

● Converts well

● Has a strong AOV

● Gets added to cart fast...

…it gets more exposure. Period.

That's why Gloda users win.

They track sell-through.

Benchmark against category averages.

Spot conversion leaks before they cost you reach.

Insight 4: Short-form video > Live streams (by far)

Videos up +29.21%

Lives down -8.94%

Lives still have a place.

But the scale now lives in:

● "First try" reactions

● "Skincare routine" demos

● "Ingredient explainers" in 15 seconds or less

If your product can't go viral in 30 seconds,

it won't go anywhere.

Make creators your content partners.

Not influencers.

Operators.

What smart sellers are doing (and you should too)

They're not guessing.

They're reading the market before it moves.

Using tools like [Gloda](https://www.gloda.vip/en) to:

● Find hot price bands before they peak

● Identify product gaps in real time

● Match SKUs with creator styles that convert

● Benchmark conversion, not just clicks

Because TikTok isn't fair.

It rewards the seller with better data and faster actions.

Final Thought:

This isn't just ecommerce anymore.

This is content-driven commerce.

You don't need more listings.

You need:

● One right price

● One clear benefit

● One creator who "gets it"

● One dashboard that shows you the signals

Gloda helps you do that.

And May's Beauty & Personal Care data proves it.

📊 Want more TikTok Shop Beauty & Personal Care insights like this?

Explore the full dataset in the latest A Professional TikTok Analytics Tool or search “TikTok Market Guide” to access top-selling SKUs, category strategies, and content performance trends—before they peak.

More recommendations